Meme stocks and housing prices are catching headlines these days. But you know what’s a better investment than those? The content you create online.

In fact, your content may be one of the best investments you can make in this lifetime.

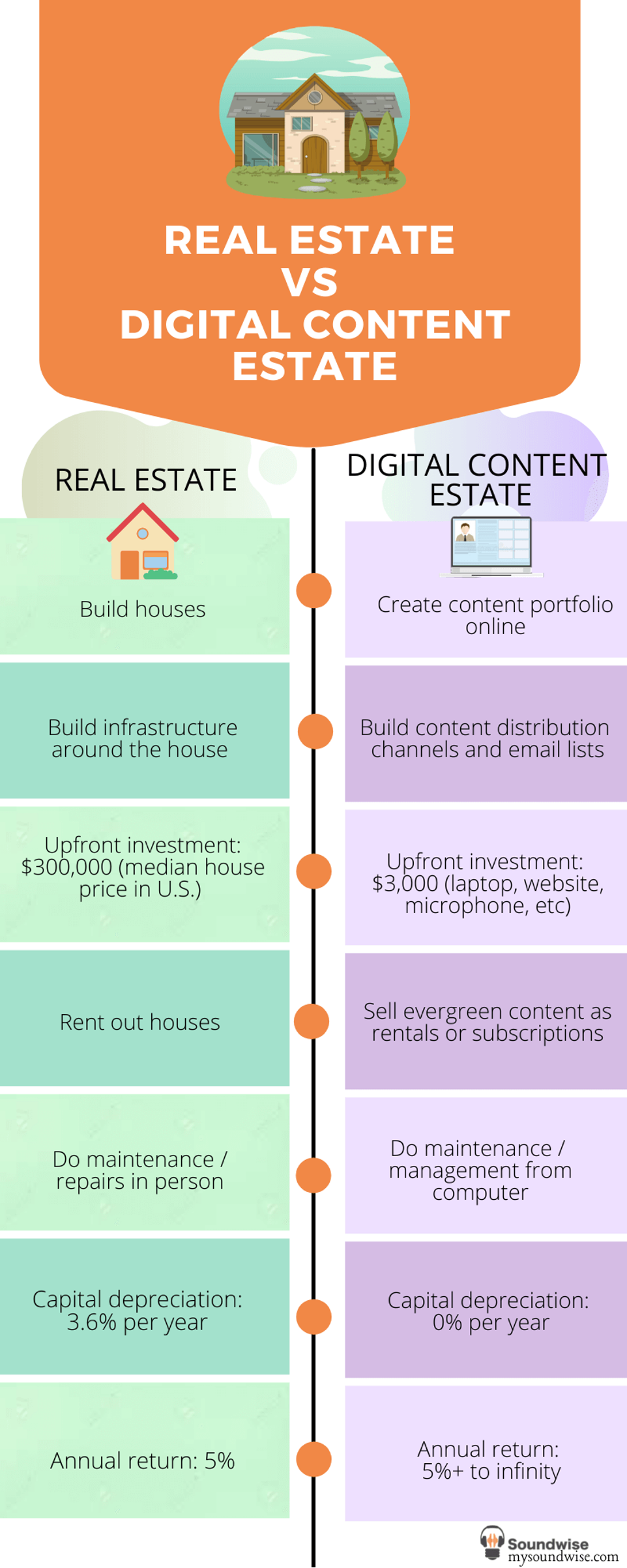

Not convinced? Let me try to explain, via a comparison with real estate.

A few years ago I decided to rent out my condo in Washington DC. Being a starry-eyed first time landlord, I figured it would be easy. They call it a “passive income”, no? So all you need is to sit back, relax, and watch money rolling in.

Little did I realize I had unknowingly got myself into a real estate agent job— posting rental ads on websites, screening tenants, arranging showings, managing contractors…you get the idea. After my tenant finally moved in (whew!), it became a property management job, while I prayed for my tenant to stay for a long time because I wasn’t too keen on being a real estate agent again.

The average annual return on capital (APR) for residential rental investment is about 5%. i.e. your rental income / your property value = 5%.

Keep that number in mind for a sec.

Now what will happen if you, instead of spending time and money buying properties and managing rentals, invest in creating digital content and building your online distribution?

Many online creators sell subscriptions. These are your paid courses, newsletters, private communities, and in the case of creators using Soundwise— private podcasts, audiobooks, and other audio recordings.

Subscriptions are similar to housing rentals in terms of income flow. When a tenant rent your house, you can think of it as they are subscribing to your house. Vice versa, when a listener subscribes to your audio library, they are renting your digital estate.

Let’s say 100 people subscribed to your content, each paying $10/month. That’s 100 x $10 x 12 = $12,000 a year. (BTW, that’s also about the average of what you earn renting out a one-bedroom apartment in the U.S., net of costs.)

How much investment would that imply if you were only to achieve a 5% annual return? $12,000 / 5% = $240,000.

But in reality, you would not need to invest nearly that much to get to 100 paying “renters” for your digital estate. Even if you start with zero content and zero audience, as long as you have something to say that’s worth listening to, and you are not completely oblivious to marketing and SEO, it would not take even close to $240,000 to build a digital content estate that overtime will host 100 “tenants”.

In other words, the APR of your content will likely be higher than 5%.

And unlike real estate, you don’t have clunky physical properties to maintain. There is no capital depreciation cost and little upkeep hassle. You can manage an empire of digital estates right on a little laptop. And you certainly don’t need a hefty mortgage loan to get started.

But here’s the most important part—

You can scale to infinity.

Unlike single family houses, there’s no upper limit on how many tenants your digital estate can be rented out to at one time.

And with we humans shifting more and more of our existence online, the demand for digital estates is only going to increase for years to come.

In the words of Nassim Taleb, investing in your digital content estate is an “asymmetric bet”, i.e. a bet that has limited downside but unlimited upside. Asymmetric bets are what allow an investor to thrive over the long term, especially in a volatile and uncertain environment.

If creating content online is like building houses, investing in your distribution (SEO, social media, affiliates, etc) is like building infrastructure-- e.g. roads and subways-- around your house. If you consistently invest in infrastructure, the value of your digital estate will appreciate over time, just like in the physical world.

But the mistake of most new creators is they think like speculators, not investors. They start their online career full of enthusiasm, making daily podcasts and weekly blogs —> three months later, they’ve gotten a total of 36 website visitors —> they proclaim the thing “doesn’t work” and move on.

If you decide to invest in content, realize you are building for the long haul. The return of this asset is not likely to shoot to the moon overnight. The noise-to-signal ratio is high in the internet land. Anybody can write. Anybody can pick up a mic and record themselves talk. Competition is fierce and audience attention scarce.

But Warren Buffett once said, “Time is the friend of the wonderful company, the enemy of the mediocre.” If you’re a long-term investor, you would be wise to invest in “wonderful companies”.

The same can be said about content. Most content online is mediocre. Their shelf life is counted in months, if not weeks. That’s why many media companies are forever running on a hamster wheel to spit out more and more (mediocre) content, just to get enough attention to survive.

But to those creators who deliberately and thoughtfully invest in quality, time is on their side. More work upfront, but their life gets easier overtime.

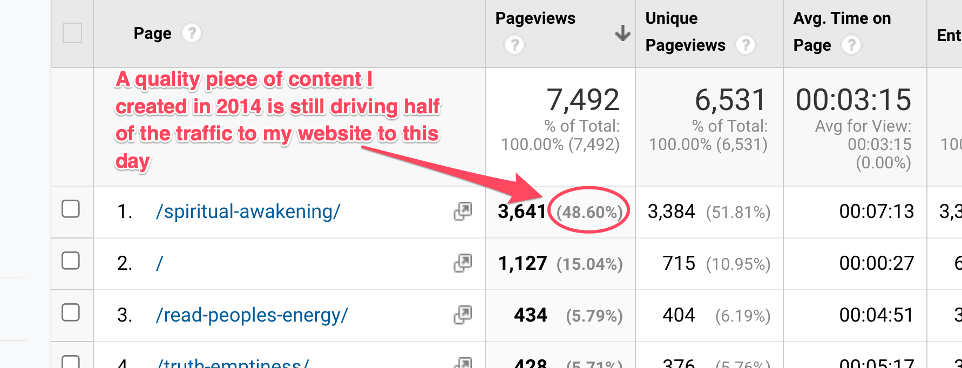

In 2014 I wrote an article about some personal epiphanies. It was not long. But I gave it all I had got and it was everything I knew about the topic at that time. Little did I expect it to resonate with so many people that years later, this article is still driving 50% of the entire traffic to my personal website. And I get grateful emails from new audience about it almost on a weekly basis.

It’s impossible to foresee home runs like this before they happen. But if you prioritize quality and strive to make everything you create count, you maximize the chance of them happening over your long and happy career as a creator.

In 15 years, people will wonder what your secret sauce is and why they can’t replicate your success overnight. You’ll tell them you don’t have any secret sauce and they won’t believe it 🤷🏻♀️